Simple model to understand r and g relationship | Summary and Q&A

TL;DR

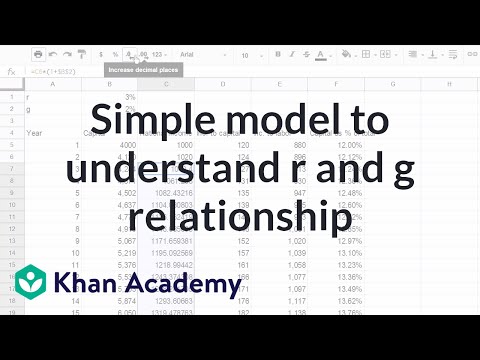

Analyzing the relationship between the return on capital (R) and economic growth (G) through a spreadsheet model to understand its impact on income distribution.

Key Insights

- 🇩🇬 When R is greater than G, the income share going to capital tends to increase, potentially leading to income inequality.

- 🇩🇬 Income going to labor also increases as R exceeds G, but the rate of increase depends on multiple factors, including population growth.

- 😘 Sensitivity analysis in the model shows that a higher R or lower economic growth can significantly exacerbate income disparity.

- 😀 It is essential to consider both R and G as well as other economic factors while analyzing income distribution and inequality.

- 💄 Capitalistic market economies naturally tend to generate inequality, making it crucial to assess the impact of income distribution on the well-being of individuals.

- 🔬 Robust economic growth can mitigate the negative effects of income concentration by benefiting both capital owners and labor.

- 🏛️ Building and experimenting with similar spreadsheet models can help in gaining a better understanding of income distribution dynamics and inequality drivers.

Transcript

- [Instructor] What I wanna do in this video is to create a simple spreadsheet to help us understand why if R greater than G, why that might lead to more and more of national income going to the owners of capital as opposed to labor. So let's just say R is 3%, we can change that assumption later. So that's the return on capital that we're assuming.... Read More

Questions & Answers

Q: How does the return on capital (R) and economic growth (G) impact income distribution?

When R exceeds G, the income going to capital as a percentage of the total income increases, which can suggest rising inequality. However, the income going to labor also increases.

Q: How is the income to capital calculated in the spreadsheet model?

The income to capital is calculated by multiplying the return on capital by the amount of capital in the economy, which gets reinvested as capital in subsequent years.

Q: Can you explain the significance of the percentage of capital in the total income?

The percentage of capital in the total income reflects the concentration of income among capital owners, potentially indicating inequality in the distribution of wealth.

Q: How does the model account for economic growth?

Economic growth is factored into the model by adding the growth rate to the previous year's national income, demonstrating its impact on income distribution over time.

Summary & Key Takeaways

-

The spreadsheet model examines the relationship between R and G to determine how it affects the distribution of national income between capital and labor.

-

By assuming specific values for R and G, the model calculates the income to capital and income to labor, as well as the percentage of capital in the total income.

-

The model demonstrates how when R is greater than G, the income going to capital as a percentage of the total income increases, potentially indicating increased inequality. However, the income going to labor also increases.

Share This Summary 📚

Explore More Summaries from Khan Academy 📚