Long straddle | Finance & Capital Markets | Khan Academy | Summary and Q&A

TL;DR

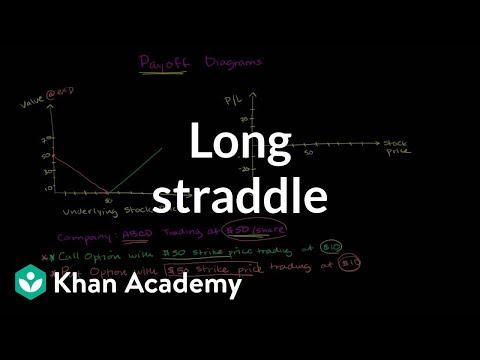

The long straddle options strategy involves buying both a call option and a put option on a stock, profiting from significant price movements in either direction.

Key Insights

- 🪘 Long straddle options strategy involves buying both a call option and a put option on a stock.

- 🏃 Exercise the put option if the stock price decreases and exercise the call option if the stock price increases.

- ❓ The strategy is profitable if the stock price has a major movement in either direction.

- 🌸 Risk is involved if the stock price remains unchanged, resulting in a loss of the initial investment.

- 🪘 Long straddle options strategy can be used when expecting significant price volatility in a stock.

- ✳️ Investors should carefully analyze the potential outcomes and risks before implementing this strategy.

- 🇨🇷 It is essential to consider the cost of purchasing both options and the potential profit to determine the viability of the strategy.

Transcript

Let's say that company ABCD is some type of a pharmaceutical company that has a drug trial coming out. And you're convinced-- it's right now trading at $50 a share-- but you're convinced that if the drug gets approved, that the company's stock is going to skyrocket. And you're also convinced that if the drug gets rejected, that the stock price is g... Read More

Questions & Answers

Q: What is the long straddle options strategy?

The long straddle options strategy involves purchasing both a call option and a put option on a stock, anticipating a significant price movement in either direction.

Q: How does the strategy work if the stock price decreases?

If the stock price drops, the put option can be exercised, allowing the investor to sell the stock for a higher price than the market value, resulting in a profit. The call option becomes worthless in this scenario.

Q: What happens if the stock price increases?

If the stock price rises, the call option can be exercised, allowing the investor to buy the stock at a lower price and sell it at the higher market value, resulting in a profit. The put option becomes worthless in this scenario.

Q: Are there any risks associated with the long straddle strategy?

Yes, there are risks. If the stock price remains unchanged, both the call and put options expire worthless, resulting in a loss of the initial investment. The strategy is profitable only if there is a significant price movement in either direction.

Summary & Key Takeaways

-

Long straddle options strategy involves buying both a call option and a put option on a stock.

-

If the stock price drops, the put option can be exercised for profit, while the call option becomes worthless.

-

If the stock price rises, the call option can be exercised for profit, while the put option becomes worthless.

Share This Summary 📚

Explore More Summaries from Khan Academy 📚