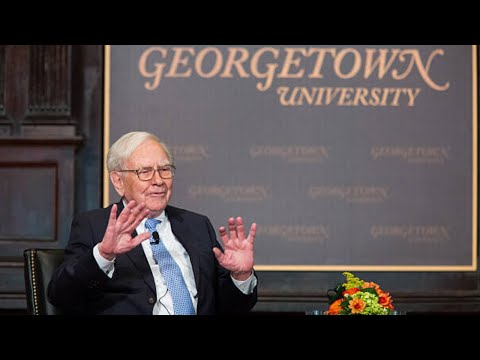

2019 Berkshire Hathaway Annual Meeting (Full Version) | Summary and Q&A

Summary

In this video, Warren Buffett and Charlie Munger of Berkshire Hathaway address various topics, including repurchasing of shares, precision railroading, Wells Fargo's fraudulent behavior, and personal investments. They also discuss the impact of socialism versus capitalism on Berkshire Hathaway and their approach to expressing their own political beliefs.

Questions & Answers

Q: Why do Berkshire Hathaway executives prefer to repurchase shares rather than spend on acquisitions?

Berkshire Hathaway only repurchases shares when they believe it is a good investment for the remaining shareholders. They focus on buying shares at a discount to intrinsic value and only when it will leave the remaining shareholders better off. Repurchasing shares is a way to improve the value for existing shareholders.

Q: Will Berkshire Hathaway consider adopting precision railroading, similar to other major North American railroads?

Berkshire Hathaway considers all strategies that could improve efficiency and customer service. Precision railroading has been successful for other railroads, and Berkshire Hathaway is open to adopting similar strategies if they see potential benefits for customers and efficiency.

Q: Why has Warren Buffett been relatively quiet about Wells Fargo's fraudulent behavior compared to his previous vocalized opinions on Solomon's misbehavior?

While Wells Fargo's behavior was concerning, Buffett believes it was a result of misaligned incentives rather than deliberate malevolence. He trusts that the company will take appropriate actions to rectify the situation. Moreover, Wells Fargo's behavior has highlighted the need for all companies to take swift action when they discover misconduct.

Q: Is Berkshire Hathaway considering meeting with a group to discuss a proposal for electrifying their railroads and opening corridors for renewable energy?

While Berkshire Hathaway constantly examines ways to improve efficiency and embrace renewable energy, there are currently no plans for such a meeting or proposal.

Q: Outside of Berkshire Hathaway, what has been Warren Buffett and Charlie Munger's most interesting or fun investment?

Warren Buffett mentioned investing in Atlead Corporation, which had 98 shares outstanding and was producing oil. The investment was successful, and it remains one of his most interesting investments. On the other hand, Charlie Munger mentioned an investment in Bellridge Oil, which went up 30 times in value. However, he missed the opportunity to make even more by turning down five times the amount he initially invested.

Q: With the discussion around socialism versus capitalism, how do the executives anticipate it impacting Berkshire Hathaway in terms of regulations, taxes, and potential breakups of its companies?

While Warren Buffett is a Democrat, he does not anticipate significant impacts on Berkshire Hathaway due to changes in regulations, taxes, or breakups of its companies. Berkshire Hathaway operates in regulated industries and needs a presence in Washington and state legislatures. They approach politics with caution and do not use company resources to further personal political beliefs.

Share This Summary 📚

Explore More Summaries from Investor Archive 📚