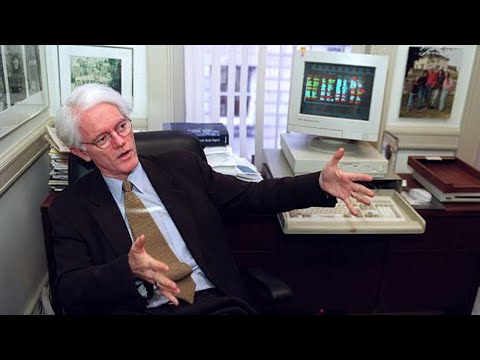

John Templeton On Bargain Hunting | 1988 | Summary and Q&A

Summary

In this video, John Templeton discusses his approach to investing and his views on the Canadian stock market. He emphasizes the importance of buying stocks when they are most depressed in price and holding them patiently for the long term. Templeton also highlights the value he finds in Canadian stocks, despite the perceived pessimism surrounding the market. He encourages investors to take advantage of bargain prices and not wait for a positive outlook before making investment decisions.

Questions & Answers

Q: How does John Templeton approach investing?

John Templeton believes in buying stocks when they are most depressed in price and holding them patiently for the long term. He advises against waiting for a positive outlook before making investment decisions.

Q: Why does Templeton hold a significant amount of his clients' money in Canadian stocks?

Templeton holds 10 percent of his clients' money worldwide in Canadian stocks because he finds bargains in the Canadian market. Although Canadian stocks make up only two and a half percent of all stocks in the world, Templeton believes they offer great opportunities for investment.

Q: How does Templeton view the Canadian stock market?

Templeton sees the Canadian stock market as a pessimistic hole where bargains can be found. He believes that the current negative sentiment in the market presents great opportunities for investors.

Q: When does Templeton think the market will change from being pessimistic?

Templeton acknowledges that it is impossible to predict when the market will change from its pessimistic state. He explains that the key is to consistently buy stocks that are most depressed in price, as they eventually tend to recover.

Q: What is the average holding period for Templeton's investments?

Templeton's average holding period for investments is five years. He emphasizes the importance of patience and holding onto stocks for the long term in order to profit from buying them at the right time.

Q: Is it a good strategy to stay out of the market when it is depressed?

According to Templeton, staying out of the market when it is depressed is not the right philosophy. He explains that share prices tend to reach low levels under the pressure of selling and they only sell under conditions of worry.

Q: Is the fear of the market being depressed a valid concern?

Templeton states that it is human nature for both individuals and professionals to wait to buy stocks until their outlook is good. However, he believes that this approach does not lead to finding bargains. Instead, he encourages investors to take advantage of low prices and not to be afraid of the market being depressed.

Q: Does Templeton believe that the Canadian market offers good opportunities?

Yes, Templeton believes that the Canadian market offers great opportunities due to the bargains he finds there. Despite the pessimistic outlook, he holds a significant portion of his clients' money in Canadian stocks.

Q: How much of the total stock market do Canadian stocks represent?

Canadian stocks make up only two and a half percent of all the stocks in the world, according to Templeton.

Q: Why does Templeton find bargains in the Canadian market?

Templeton finds bargains in the Canadian market due to its current pessimistic sentiment. He believes that the market's negative outlook creates opportunities for investors to buy stocks at low prices.

Takeaways

John Templeton's investment philosophy emphasizes the importance of buying stocks when they are most depressed in price and holding onto them patiently for the long term. He believes that the Canadian stock market, despite its pessimistic reputation, offers great opportunities for investors to find bargains. Templeton encourages investors to take advantage of low prices and not to wait for a positive outlook before making investment decisions. Overall, his approach highlights the value of being contrarian and staying committed to investments over the long term.

Share This Summary 📚

Explore More Summaries from Investor Archive 📚