Carl Icahn's First Ever Interview | 1985 | Summary and Q&A

Summary

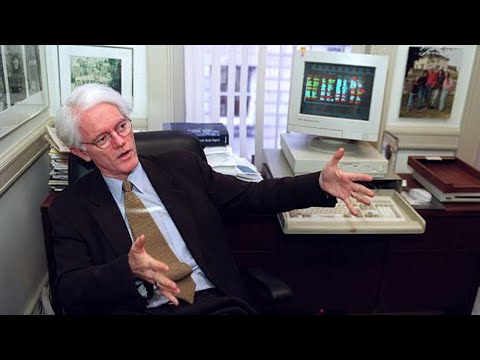

This video provides a profile of business mogul Carl Icahn, who has gained a reputation for his takeovers of numerous companies. He has recently made headlines for his billion-dollar deal to acquire Trans World Airlines (TWA) and his search for additional financing for future acquisitions. Despite rarely giving interviews, Icahn agreed to speak with correspondent June Masel for this profile.

Questions & Answers

Q: Who is Carl Icahn and what is he known for?

Carl Icahn is a prominent figure in American business known for his threatened or actual takeovers of numerous companies. He recently arranged a billion-dollar deal to take over TWA and is seeking additional funding for future acquisitions.

Q: What was Icahn's first major takeover and when did it occur?

Icahn's first major takeover was in 1979 when he bought the company Tap and Stove. This marked the beginning of his ventures into the world of takeovers.

Q: How did Icahn's journey as a takeover specialist begin?

Icahn got started in business with the help of Elliot Schnall, known as Uncle Elliot, who loaned him $400,000 in 1968 to buy a seat on the New York Stock Exchange. Initially focusing on options and arbitrage, Icahn later turned to takeovers, despite skepticism from Uncle Elliot and others.

Q: How has Icahn's approach to takeovers been received?

Icahn has faced criticism for his tactics, particularly for his use of greenmail, where a company buys back Icahn's stock at a premium. While Icahn and others argue that he hasn't accepted greenmail in a while, his actions have still garnered negative attention.

Q: How does Icahn choose which stocks to buy?

Icahn's strategy is to look for undervalued stocks, particularly those with prices below the true value of the company. He believes in only buying stocks that are bargains, as opposed to those whose prices have already increased.

Q: How successful has Icahn been at taking control of companies?

While Icahn has engaged in numerous hostile takeover battles, he has only actually taken control of three companies. However, in all cases, his company has made significant profits, with some deals earning as much as $25 million.

Q: How did Icahn secure labor concessions during the TWA takeover?

Icahn successfully negotiated labor concessions during the TWA takeover, something the airline's management had been unable to achieve. The pilots and machinists agreed to salary cuts in exchange for a small ownership stake in the company if Icahn took over.

Q: How does Icahn view the role of management in corporations?

Icahn believes that many companies are poorly managed and hindered by excessive bureaucracy, which leads to lower stock prices. He argues that the real value of a company is often higher without its management.

Q: What does Icahn consider the biggest problem in corporate America?

Icahn criticizes what he calls the "corporate culture" with its extravagances such as private jets, golf courses, and high salaries. He believes this aristocratic culture is prevalent in the corporate world, hindering effective management.

Q: What motivates Icahn in his pursuit of takeovers?

Icahn's primary motivation is making money, and he acknowledges that this is a fundamental part of his value system. However, he also believes that he is doing the right thing by driving up stock prices and benefiting shareholders.

Takeaways

Carl Icahn is a renowned figure in American business, known for his aggressive approach to takeovers and for reshaping companies. Despite criticism for his tactics and the use of greenmail, Icahn has achieved significant success in his career. His strategy involves identifying undervalued stocks and acquiring them at bargain prices. He also believes that many companies suffer from poor management and an aristocratic corporate culture, which leads to lower stock prices. Ultimately, Icahn's primary motivation is making money, but he also believes he is serving the best interests of shareholders.

Share This Summary 📚

Explore More Summaries from Investor Archive 📚