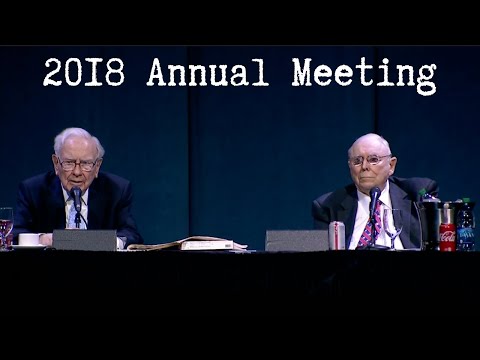

2018 Berkshire Hathaway Annual Meeting (Full Version) | Summary and Q&A

Summary

In this video, Warren Buffett and Charlie Munger answer a variety of questions from shareholders. They touch on topics such as capital allocation, the current state of the economy, cyber risk, and their views on the trade war between the U.S. and China. Buffett shares personal anecdotes and insights into his investing philosophy, emphasizing the importance of long-term thinking and the benefits of investing in American businesses. Munger, as usual, provides his succinct and direct commentary on the topics discussed.

Questions & Answers

Q: Can you introduce the other directors of Berkshire Hathaway?

At the upcoming formal meeting, 14 directors will be elected. Other than Buffett and Munger, the other directors are Greg Abel, Howard Buffett, Steve Burke, Sue Decker, Bill Gates, Sandy Gottesman, Charlotte Guyman, Ajit Jain, Tom Murphy, Ron Olson, Walter Scott, and Merrill Whitmer.

Q: Buffett mentioned the new accounting rule that affects the earnings of Berkshire Hathaway. Can he explain it in more detail?

The new accounting rule, introduced this year, requires marking to market every day for equity securities, regardless of whether they are sold or not. This means that there can be significant gains or losses in Berkshire's equity securities portfolio. This accounting change can lead to unusual effects in the reported earnings. However, operating earnings, which exclude these gains or losses, showed a record amount for any quarter.

Q: How did Berkshire Hathaway perform in the first quarter?

Berkshire reported strong operating earnings, with many businesses performing well. Geico had a good size turnaround in profitability, although not as big as the previous year. The railroad and other businesses also showed significant growth. The reduction in the federal income tax rate further enhanced the gain in earnings. Overall, it was a solid quarter for Berkshire.

Q: How should investors approach investments and focus on the long-term rather than short-term fluctuations?

Buffett takes a long-term perspective on investments and emphasizes the importance of not getting caught up in day-to-day market movements. He shares a personal story from 1942 when he invested in a stock during a difficult time but eventually made a profit because he believed in the long-term prospects of America and its businesses. The key is to have a philosophy that you stick with and not get distracted by short-term noise.

Q: How does Berkshire Hathaway view the ongoing trade war between the US and China? Is there a win-win situation?

Buffett believes that the US and China will continue to be the two superpowers of the world economically for a long time. While trade tensions may arise, both countries have a lot of common interests and benefits from global trade. Buffett expresses optimism that both nations will find ways to resolve their differences and not risk sacrificing world prosperity. He emphasizes the importance of free trade and the benefits it brings to both countries and the world.

Q: Are there opportunities for outstanding capital allocation in the public sector at the state and federal levels?

Buffett and Munger don't believe there is a similar opportunity for outstanding capital allocation in the public sector. They point out that the motivations, rewards, and structures are different in the public sector compared to the private sector. They don't offer any specific suggestions for achieving better capital allocation in the public sector.

Q: How does Berkshire Hathaway view cyber risk and prepare for it?

Buffett admits that cyber risk is a significant concern, but also acknowledges that it's an area where they don't have all the answers. He believes it is a rapidly evolving field and that no one truly knows all the probabilities or potential risks. Berkshire tries to avoid being a pioneer in this space and doesn't aim to be a top player in cyber insurance. Buffett mentions that it's important to have proper incentives in place and to address any wrong behavior promptly.

Q: Should Berkshire Hathaway change its investment in Wells Fargo considering the bank's history of scandals and misbehavior?

Buffett acknowledges that Wells Fargo made serious errors when it came to its incentive system and the behavior of its employees. Berkshire believes in having the right incentives and taking action when wrongdoing occurs. However, Buffett points out that Berkshire itself has made investments in companies in the past that had faulty incentive systems, such as American Express and GEICO. He believes that these companies have the ability to learn from their mistakes and improve.

Takeaways

Buffett and Munger provide insights into a range of topics including Berkshire Hathaway’s performance, investing in American businesses, the trade war between the US and China, cyber risk, and capital allocation. Buffett emphasizes the importance of long-term thinking and avoiding short-term market fluctuations. He shares personal anecdotes to illustrate his investment philosophy. Munger, known for his direct and concise commentary, offers his thoughts on various topics. Overall, the key takeaways from the video are:

- Berkshire Hathaway had a strong first quarter, with many businesses performing well.

- Long-term thinking and investing in American businesses has been a successful strategy for Berkshire.

- The trade war between the US and China should be viewed as a win-win situation, with both countries having common interests and benefits from global trade.

- Cyber risk is a significant concern, and Berkshire takes measures to avoid being a pioneer in the space.

- Wells Fargo's scandals illustrate the importance of having the right incentives in place and taking action against wrongdoing.

- There is limited opportunity for outstanding capital allocation in the public sector due to different motivations and structures compared to the private sector.

Share This Summary 📚

Explore More Summaries from Investor Archive 📚